irs child tax credit dates

So using Nuñezs example that 600 wouldnt have to be repaid per se. The IRS said on Thursday that it is sending out letters to those who may be eligible to claim some or all of the Child Tax Credit the 2021 Recovery Rebate Credit and the Earned.

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

You may get to keep more of your money in 2023.

. The payment for the. The IRS has created a special Advance Child Tax Credit 2021 page with the most up-to-date information about the credit and the advance payments. The calculation of the child tax credit in 2023 will be different than in previous yearsAs inflation increases the credit amount will decrease.

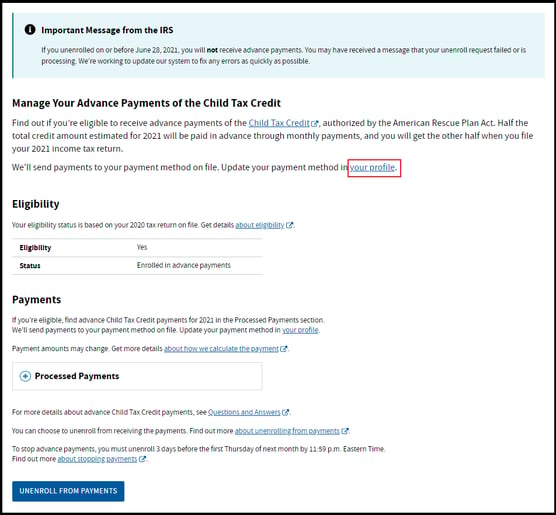

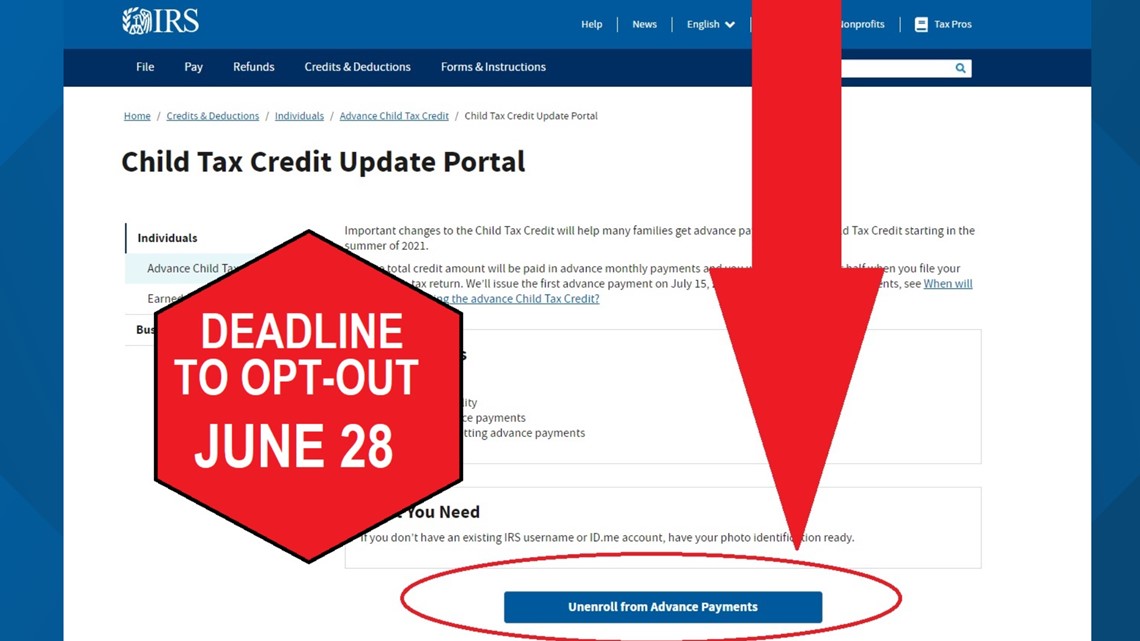

To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. The IRS will send out the next round of child tax credit payments on October.

They could also get up to 250 per qualifying child between 6 and 17 years or a total of 3000. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. Another reason the IRS could seize your child tax credit is if you have passed due federal debt.

The last round of monthly Child Tax Credit payments will arrive in bank accounts on Dec. It was previously refundable only up to 1400 per child and families needed to earn at. IRS could seize your child tax credit part three.

1200 in April 2020. Reaction on the Hill. The Internal Revenue Service wants more than 9 million people who did not get COVID-19 stimulus payments child tax credits or any other tax credits to claim their money.

Heres what to expect from the IRS in 2022. Have been a US. It would simply be deducted.

13 hours agoArnold says the IRS is pushing up 2023 tax brackets by about 7 percent. To satisfy past debts the. The child tax credit is not indexed for inflation so it is stuck at the same level it was in 2022.

As of now the child tax credit is worth 2000 per. The American Rescue Plan also made the Child Tax Credit fully refundable for 2021. Those with one child could earn up to 3618 in earned-income tax credit while those.

IR-2021-153 July 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving. For individuals the standard. 600 in December 2020January 2021.

18 hours agoThe American Rescue Plan raised the earned-income tax credit from 543 to 1502. 17 hours agoThe IRS has some good news for Americans struggling with rampant inflation. 1 day agoIn this latest round of changes by the IRS the top income tax rate of 37 percent will apply in 2023 to those individual taxpayers earning 578125 or 693750 for married couples.

The IRS will be holding half of the overall Child Tax Credit in reserve. The percentage depends on your income. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

These adjustments are due to inflation and include the largest increase to the standard deduction since 1985 The Washington Post reports. Zelle Facebook Marketplace Scam.

Stimulus Update Important Dates For Next Child Tax Credit Payment When Will Money Arrive Al Com

Child Tax Credit Irs Final Deadline Here For Low Income Families 10tv Com

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit What We Do Community Advocates

Important Child Tax Credit Form Coming For Families In The Mail Kare11 Com

Child Tax Credit Payments What S Next

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

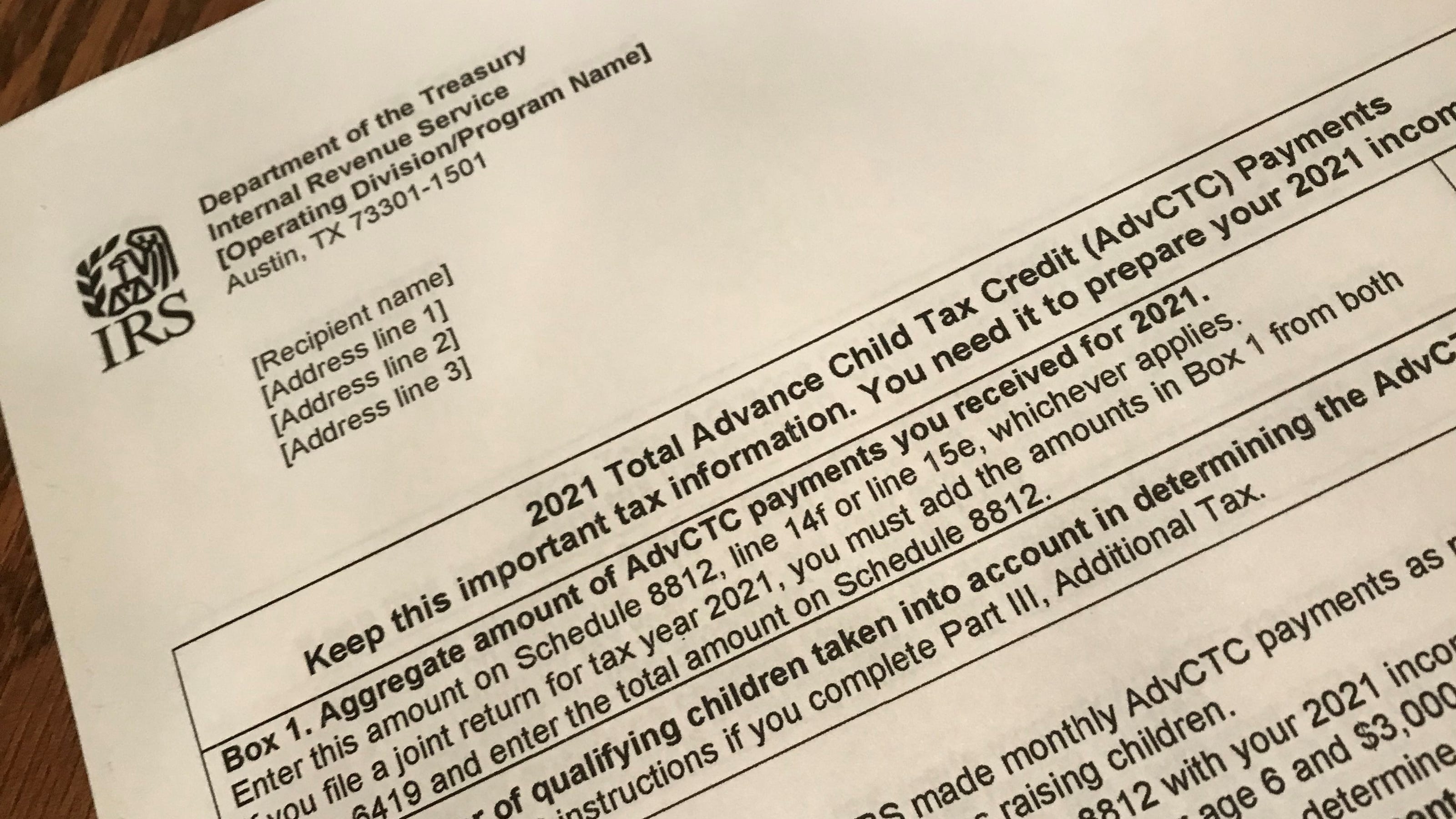

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Financial Aid Irs Social Security Recipients Child Tax Credit Irs Tax Refund Deposit Date 11 February As Usa

Franklin County Department Of Job And Family Services Update The Irs Estimates About 90 Of Children In The U S Are Scheduled To Begin Receiving Monthly Payments From The Child Tax

Financial Aid Social Security Child Tax Credit Irs Tax Refund Deposit Date 1 March As Usa

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments